Property tax laws in California just got shaken up a bit. People who inherit property from their parents and grandparents are facing some new changes.

To understand Proposition 19, let’s start with what California’s Proposition 13 is. Proposition 13 of 1978 was an amendment to the California Constitution that set base year values.

This meant that assessments couldn’t exceed 2% each year and that property taxes were limited to 1% of the assessed value. The goal here is to limit property taxes.

You might be wondering what Proposition 19 is and how this all relates. Proposition 19 is the Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act. In November of 2020, this Act was passed to be effective by February 16, 2021.

Proposition 19 limits benefits that Proposition 13 once granted homeowners and their families. This means that some homeowners will face excessive property tax rates now that Proposition 19 is in action.

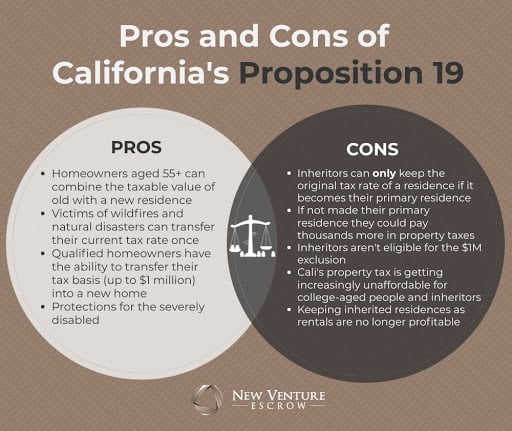

It is important to know how Proposition 19 will affect you as you get older and possible future plans you may have for your properties. Continue reading because as we go in-depth into who may be affected, how to prepare for these changes, and the advantages and disadvantages of Proposition 19.

Positive Effects of Proposition 19

This Act benefits homeowners who are over 55 years old, disabled, or victims of natural disasters.

For starters, homeowners who are 55 years old and up can combine the taxable value of their old residence with their new one, resulting in property tax savings.

Additionally, victims of wildfires or natural disasters can transfer their current rate once.

Seniors can also transfer their replacement property up to three times now, which was increased from one time.

Furthermore, qualified homeowners have the ability to transfer their tax basis (up to $1 million) anywhere. They can transfer their residency’s assessed value into a new home.

Negative Effects of Proposition 19

Under California’s prop 13, parents were able to pass down their residence to their children without fair market reassessment. Fair market assessment is triggered by a change in ownership.

However, under Proposition 19, inheritors can only keep the original tax rate of the residence if they use it as their primary residence.

If inheritors choose to do otherwise they then have to pay the current assessed value. That means they could have to pay thousands of dollars more than their parents! Not to mention, they wouldn’t even be eligible for the $1 million exclusion.

As California property tax increases on these inherited homes, the inheritors will find it increasingly unaffordable.

In the long run, they’ll be forced to sell because even keeping these homes as rental properties will be profitless.

Who Will Be Affected and How to Prepare?

As anticipated, California property tax rules will change from time to time. With the recent passing of Proposition 19, residents of California will feel the effects, some positive and some not so much.

Families who were trying to create generation wealth felt that all their efforts to have and leave a home to their children were being attacked.

Inheritors get the short end of the stick in this case. Older homeowners may experience certain protections and a tax break.

Since the first round of this amendment took place on February 16th, many parents had started looking for ways to still leave a home to their children.

There may be some legal action that can be taken to outmaneuver Proposition 19. Firms like Cunningham Legal are pursuing the “Family Property LLC” concept that may be suitable for some families.

Unfortunately, it is still very likely that children or grandchildren will have to pay a higher California property tax in the case that their family doesn’t seek outside legal help.

This is because the Act terminated the parent/child exclusion that formerly protected families from high property tax reassessments.

Additionally, starting April 1st, eligible homeowners can sell and take their property tax base value with them in California.

Furthermore, it is expected that college-aged residents are likely to seek other states to live in because they simply won’t be able to afford California’s prices.

Despite the expected fleeing of that particular market of buyers, California realtors believe that California will always have a certain appeal. Therefore, a new market of buyers is expected to replace them.

Need Some Guidance Navigating California’s Real Estate Market?

New Venture Escrow is a transparent, efficient, and secure escrow company in California. And they make their clients their number one priority!

So, if you need assistance in navigating the new changes implemented by Proposition 19 or keeping up with the current real estate market in California, don’t hesitate to contact us at New Venture Escrow!